Belt and Road Initiative Promotes Green Development of Countries and Regions along Belt & Road

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn/Chinagate.cn, May 16, 2022

E-mail China.org.cn/Chinagate.cn, May 16, 2022

According to the 2021 Global Institutional Investor Survey released by Morgan Stanley Capital International (MSCI), the global market has greatly enhanced the recognition of sustainable development because of the COVID-19 pandemic (hereinafter referred to as “the pandemic”). The Emissions Gap Report 2020 released by the United Nations Environment Programme shows that the carbon emissions of G20 economies account for 78% of the global carbon emissions. Currently, nine economies (France, the United Kingdom, China, Japan, South Korea, Canada, South Africa, Argentina, and Mexico) have put forward their net zero carbon emission target. EU countries have put forward the goal of achieving net zero carbon emissions by 2050. However, no large economy has ever achieved carbon neutrality so far. Although the pandemic has caused a temporary decline in global carbon dioxide (CO2) emissions, the world is still moving towards a global warming of more than 3 °C by the end of the 21st century. This poses a serious challenge to the goals of Paris Agreement. All countries need to put in great efforts to achieve carbon neutrality.

In September 2020, China made a pledge to achieve carbon neutrality by 2060. According to the McKinsey report Leading the Battle Against Climate Change: Actions for China, with China’s net greenhouse gas emissions in 2016 being 16 billion tons of CO2 equivalent, it is a daunting task to achieve net zero carbon emissions 40 years later. To achieve carbon neutrality, China is currently facing multiple challenges. For example, China’s coal consumption accounts for a high proportion, and it is an arduous task to optimize the energy structure and establish a green and low-carbon economic system. Meanwhile, China’s manufacturing industry is at the middle and low end of the global value chain, and the task of economic restructuring and industrial transformation is a formidable one.

Economies along the Belt and Road (herein after referred as Belt & Road countries and regions) are facing the common challenges of eco-environment and climate change. While introducing capital for faster development, they undergo the largest transformation toward green and low-carbon transformation in history. Most of them are developing or underdeveloped countries, and require massive investment for green transformation and development. Currently they are not large economies, and have a low share of global greenhouse gas emissions. According to the World Bank’s World Development Indicators (WDI), in 2014, 24 out of the 56 Belt & Road countries and regions have a higher proportion of fossil fuel consumption than the average level of the Organization for Economic Co-operation and Development (OECD). Therefore, the proportion of renewable energy in these countries’ structure needs to be increased from now on, or the economic development of these countries will become negative assets in the unified global carbon emission reduction efforts. Whether developing countries can achieve low-carbon development will play a decisive role in global climate change. Their efforts to implement green and low-carbon development in the global production network will have a great impact on global carbon emissions and carbon neutrality.

Under the backdrop of some major uncertainties in the international economy and China’s economic operation, we employ economic theory and input-output model to analyze the green and low-carbon development of the Belt & Road countries and regions and the impact of China’s outward direct investment (ODI), and then put forward some policy recommendations to aid policy makers in their decision making.

Against the backdrop of shrinking global investment market, China beefs up green investment in the Belt & Road countries and regions

Despite the shrinking global investment market, the scale of green financing continues to grow

According to the World Investment Report 2020 by the United Nations, foreign direct investment (FDI) inflowing into Asian developing economies reached about 474 billion US dollars, falling by 5%, in 2019. Although the FDI inflowing into South Asia and Southeast Asia increased by 10% and 5%, respectively, this increase did not suffice to offset the FDI decline in East Asia and West Asia (13% and 7%, respectively). According to the latest issue of the Global Investment Trend Monitor released by the United Nations Conference on Trade and Development (UNCTAD), global FDI in the whole year of 2020 fell by 42% year on year to 859 billion US dollars due to the severe impact of the economic downturn caused by the pandemic, with developed countries bearing the brunt. The FDI flowing into developed countries fell by 69% year on year to 229 billion, hitting its lowest level in the past 25 years. The FDI flowing into developing economies fell by 12% to 616 billion US dollars. In 2020, developing countries in Asia attracted a total of approximately 476 billion US dollars in FDI, among which China was the world’s largest FDI recipient, with its FDI inflow rising by 4% to 163 billion US dollars.

Despite the impact of COVID-19 pandemic, the scale of global green financing continues to grow. According to the Climate Bonds Initiative (CBI), by the end of 2020, global green bond issuance reached a record high of 269.5 billion US dollars, slightly higher than the 266.5 billion in 2019. The United States issued the most green bonds with a total value of 51.1 billion, followed by Germany’s 40.2 billion US dollars and France’s 32.1 billion US dollars. The proceeds of these green bonds were mainly for investment in the energy industry, followed by low-carbon buildings and low-carbon transportation. Asia is the main destination for investment inflows, and China has played an important role in green finance. According to data from the People’s Bank of China, as of the end of 2020, the balance of China’s green loan was around CNY 12 trillion, which was the largest of the world; the total outstanding green bonds of China reached CNY 813.2 billion, ranking the second in the world; the development of inclusive finance in China supported the construction of green infrastructure such as photovoltaic power generation.

ODI between China and the Belt & Road countries and regions gets increasingly active

Statistics from the World Bank’s WDI shows that the balance of foreign trade in goods and services of the Belt & Road countries and regions has shown a growing trend from 2015 to 2018, and these countries have become increasingly active in international trade. Of note, the ODI flow between China and Belt & Road countries and regions has become more frequent. According to the Report on Development of China’s Outward Investment and Economic Cooperation 2020 issued by the Ministry of Commerce, China’s ODI flow to Belt & Road countries and regions has increased steadily from 2013 to 2019, reaching a total of 117.31 billion US dollars. Investment ties between those countries are getting closer and closer. The active ODI countries along the Belt and Road include Singapore, Indonesia, Vietnam, Thailand, Kazakhstan, and Russia, which are concentrated in Asia.

China has played a positive role in the green investment in Belt & Road countries and regions

China is the main source of investment for Belt & Road countries and regions. According to calculations based on the transnational investment positions published by the Coordinated Direct Investment Survey (CDIS) of the International Monetary Fund (IMF), China’s ODI to Belt & Road countries and regions accounted for 12.46%, 7.82%, and 8.41% in the total foreign investment absorbed by these countries from 2016 to 2018, which is higher than that of other developed countries such as Singapore, the United States, and South Korea. One important role of green finance is to optimize the allocation of resources to deal with environmental damage. China actively organizes and promotes green investment in Belt & Road countries and regions while meeting their infrastructure development needs and reducing global carbon emission. On April 25, 2019, China signed the Green Investment Principles with 27 large financial institutions from countries and regions including France, Germany, Japan, Kazakhstan, the United Arab Emirates, the United Kingdom, and Hong Kong. As of September 2020, 37 signatories and 12 supporting organizations from 14 countries and regions around the world have participated in this program. In 2019, China and the European Union jointly launched the International Platform for Sustainable Finance (IPSF) to address climate change by leveraging the green investment and finance cooperation in Belt & Road countries and regions.

In the post-pandemic era, the willingness to reduce carbon emissions and increasing concern of financial institutions on climate risks, coupled with China’s rich experience in renewable energy, will increase the proportion of renewable energy projects in Belt & Road countries and regions. Currently, Bangladesh, Pakistan, Egypt, and other countries along the Belt and Road have cancelled large-scale coal-fired power plants. China is also actively adjusting its energy investment deployment in Belt & Road countries and regions and guiding funds to the renewable energy sector. According to the American Enterprise Institute (AEI), in the first half of 2020, China’s investment in the energy sector of Belt & Road countries and regions has been growing, reaching a total of 8.81 billion US dollars. The investment in renewable energy accounts for 58.1%, exceeding the proportion of fossil energy investment for the first time. However, the green finance markets in Belt & Road countries and regions are still at their initial stage, and China faces challenges from these renewable energy projects. For example, Chinese investment seldom adopts the hybrid financing model with multilateral institutions, and domestic credit insurance institutions still lack the standards to assess risks associated with renewable energy projects and countries. It shows that there is still room for improvement in China’s climate finance development.

China’s ODI under carbon neutrality has a positive effect on Belt & Road countries and regions

According to the data of WDI, we calculated the carbon emissions of Belt & Road countries and regions. From 2010 to 2016, their carbon emissions increased from 9.627 billion tons to 10.042 billion tons, accounting for about 30% of the world’s total. Thus, the Belt & Road countries and regions have great potential for green emission reduction. This paper proposes a model to measure the impact of China’s ODI on the carbon emissions of Belt & Road countries and regions to clarify the role of China’s ODI in their green development.

Introduction to the calculation method of impact of China’s ODI on the carbon emissions of Belt & Road countries and regions

According to the eclectic theory of international production presented by Dunning et al., the main motivation of ODI is to obtain the location advantage of the host country relative to its own country based on the company’s ownership and internalization advantages. The main forms of ODI include greenfield investment and cross-border mergers and acquisitions, both of which will cause changes in the assets of the host country. For example, the establishment of new factories, production expansion, improvement of production lines, and fixed capital formation can well reflect this change in assets. That is, changes in the fixed capital formation in the host country will be affected by investment. According to Grossman & Krueger, changes in economic activities are closely related to variations in energy consumption and carbon emissions. On the basis of this theory, we built a model for measuring the impact of China’s ODI on the carbon emissions of Belt & Road countries and regions. The key points of the model are as follows: (1) calculation of fixed capital formation—China’s ODI elasticity to Belt & Road countries and regions, namely the subsequent rate of change in the fixed capital formation in those countries for every 1% of change in China’s ODI; (2) introduction of calculated elasticity into the interregional input-output model for the measurement of the change in the host country’s carbon emissions caused by the change in fixed capital formation due to China’s ODI; (3) calculation of value added of China’s ODI to Belt & Road countries and regions based on the interregional input-output model and the subsequent carbon emission intensity. The comparison of calculated carbon emission intensity with the current intensity will reveal whether China’s ODI increases or reduces carbon emissions in these countries and regions when creating the same scale of value added.

According to the investment destinations and other relevant factors in the Report on Development of China’s Outward Investment and Economic Cooperation 2020, we chose 25 Belt & Road countries and regions with more active ODI activities and used a two-way fixed-effect panel model to

*A negative value means that compared with the existing carbon emission intensity in host country, generating the same scale of value-added, China’s ODI reduces local carbon emission, while a positive value means that China’s ODI increases local carbon emission.

calculate the elasticity of fixed capital formation—China’s ODI, the main data come from the World Bank and the Ministry of Commerce of China as well as the 2014 input-output table compiled by our research team. It is assumed that their average production structure, technology level, and carbon emission intensity in the global production network from 2009 to 2018 is equivalent to those in 2014. The impact of the host country’s carbon emissions caused by the cumulative increase of China’s ODI in the past decade has thus been calculated. The input-output table contains 29 production sectors in 78 countries and economies, of which 53 are Belt & Road countries and regions.

Table 1 Impact of China’s ODI on carbon emissions of Belt & Road countries and regions (Unit: Ten thousand tons)

From a regional perspective, China’s investment in these countries has different emission mitigation

Model calculations show that China’s ODI has a positive effect on the formation of a green investment deployment in Belt & Road countries and regions. From 2009 to 2018, China’s ODI to the above 25 countries increased by 786%, resulting in a total of 471.81 million tons of carbon emissions and a value added of 1.34 trillion US dollars. Every 1% increase in ODI brought about 410 thousand tons of carbon emissions and 879.8 million US dollars of value added. Compared with the current local production level, to create the same value added, China’s ODI can reduce local carbon emissions by 44.78 million tons.

From a regional perspective, China’s investment in ASEAN countries has reduced local carbon emissions by 15.84 million tons. China’s investment in Russia, Mongolia, and five Central Asian countries has reduced local carbon emissions by 21.07 million tons. The investment in Central and Eastern Europe and Southern Europe has reduced local carbon emissions by 7.86 million tons. In general, the countries in Central and Eastern Europe and Southern Europe have a higher degree of vertical specialization. On one hand, these countries have comparative advantages in automobile industry, equipment manufacturing industry, and machinery and equipment industry, and high economic development level. On the other hand, the close trade exchanges with the developed EU economies are conducive to the technological development of the Central and Eastern European countries and the spillover effects provide a comparative advantage in their green production.

From a national perspective, the carbon emission reduction due to China’s ODI respectively accounted for 16.89%, 11.94%, and 8.36% of the total local carbon emissions in Austria, Laos, and Indonesia in 2014. Table 1 shows the impact of China’s ODI on the local carbon emissions in 2014. It can be concluded that China’s ODI has cut down the carbon dioxide emission in most Belt & Road countries and regions, especially in Russia, Mongolia, and the five Central Asian countries. However, the comparative advantage of central and Eastern European and Southern European countries in green production leads to a weaker carbon emission reduction effect brought by China’s ODI. Therefore, Belt & Road countries and regions can use their own comparative advantage and leverage intra-product division of labor in the global production network, which will help to reduce the overall emissions.

Based on the above results, one of the key measures to achieve the win-win situation of Belt & Road countries and regions is to strengthen economic connections to stimulate investment deployment and economic growth. Good economic and investment deployment will effectively connect these countries with each other, reduce the cost of economic transactions, and realize the complementary advantages of a large economic zone. The Belt & Road countries and regions that rely heavily on energy (especially petroleum resources) for development should integrate themselves into the global value chain to accelerate the green transformation and upgrading of their economy through cooperation with large economic zones.

From the industry perspective, China’s ODI to Belt & Road countries and regions shows greening characteristics

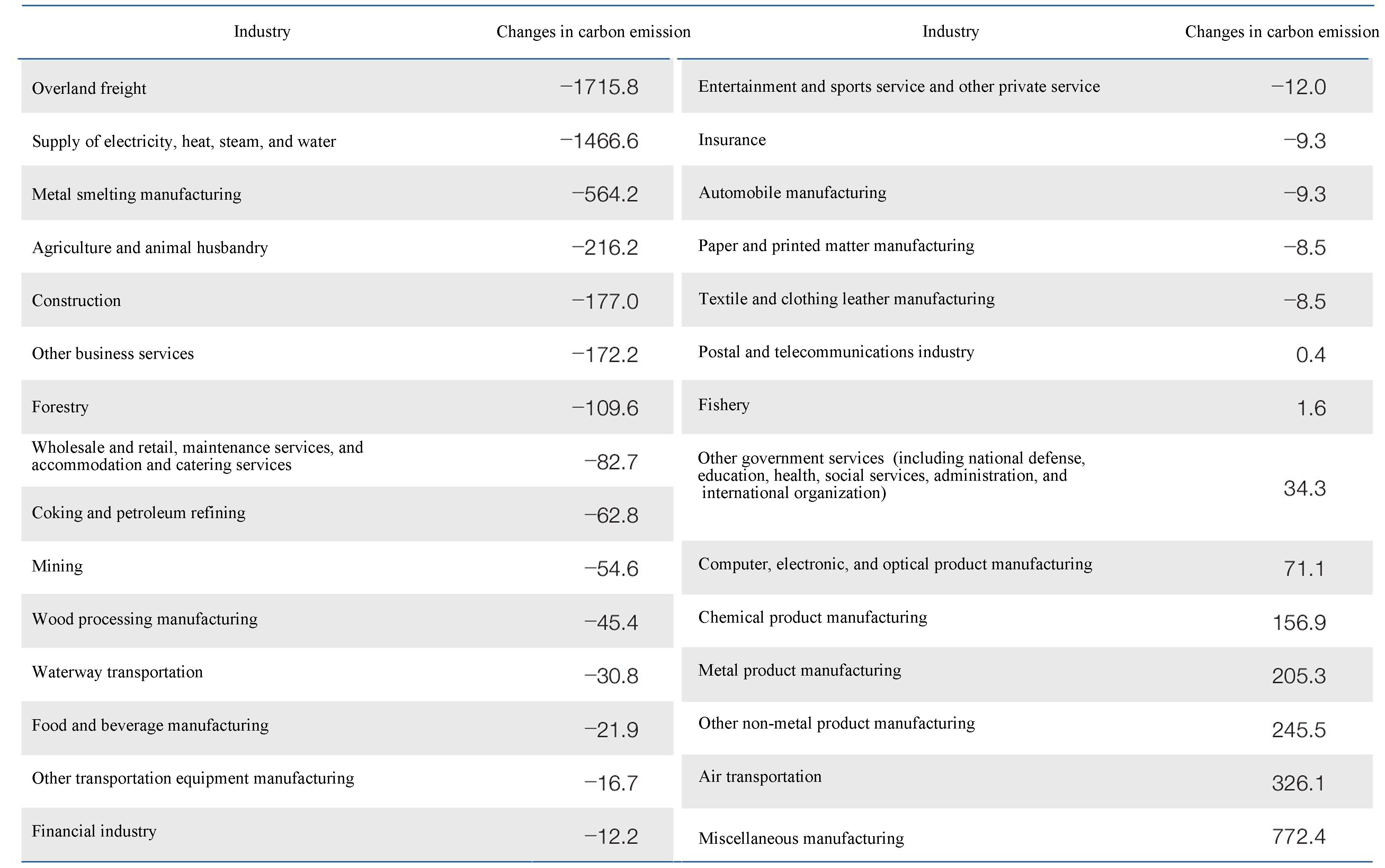

Industry analysis shows that the carbon emission reduction effects of China’s ODI are manifest in industries such as land transportation, power generation, and metal smelting and manufacturing. The cumulative emission reduction of all industries has reached 47.96 million tons, which is almost equivalent to Belarus’ carbon emissions in 2014 (Table 2). Projects attracting most of China’s ODI inflows are mainly from industries like miscellaneous manufacturing, air transportation, metal and non-metal product manufacturing, and chemical product manufacturing, which tend to increase local carbon emissions by 18.13 million tons totally. According to the Report on Development of China’s Outward Investment 2019 released by the Ministry of Commerce, China’s investment plays an important role in power generation industry and mining industry in 2018. Foreign contracted projects and infrastructure construction are an important support of the Belt and Road Initiative. The emission reduction industries mentioned above are China’s main outward direct investment in Belt & Road countries and regions. It can be concluded that China’s ODI in these countries has green features.

Policy recommendations

Cooperating with Belt & Road countries and regions to explore technology-driven sustainable development systems and promote low-carbon technology transformation in key industries

(1) Actively participating in the clean energy construction to jointly explore a technology-driven low-carbon development path for the Belt & Road countries and regions. We should further promote the R&D and application of clean energy such as renewable power generation, smart grid, power storage, hydrogen energy utilization, carbon capture and storage, and ocean negative emission technology, and jointly explore low-carbon development paths that are driven by technological innovation. Efforts should be made to strengthen the construction and management of sustainable development systems to reduce the cost of eco-environment and climate impacts brought by economic development. It is advisable that Chinese companies utilize core technological advantages to help those countries gradually develop renewable power generation projects that are currently difficult to accomplish and strive to establish local key creative projects to enhance the green influence of China’s foreign investment.

Table 2 Impact of China’s ODI on carbon emissions of industries of Belt & Road countries and regions (Unit: Ten thousand tons)

Data source: Carbon emission data in the GTAP10 database, the inter-regional input-output table for Belt & Road countries and regions in 2014, and data from World Development Indicators by the World Bank.

(2) Promoting the transformation and upgrading of economic development mode in the countries relying on energy (especially petroleum resources). The industries that increase local carbon emissions are mainly in the fields such as miscellaneous manufacturing, air transportation, metal and non-metal product manufacturing, and chemical product manufacturing. Therefore, it is advisable that the above mentioned industries should take the lead in low-carbon transformation and technological innovation, and fully utilize China’s large market and leverage scale economy to improve their energy efficiency.

Establishing a coherent green development policy for Belt & Road countries and regions

(1) Encouraging the Belt & Road countries and regions to propose or update their Nationally Determined Contribution (NDC) plans and announce their own carbon neutrality goals in the reconstruction of greening global value chain. Different countries have made different progress as to the goals of zero carbon and carbon neutrality. Countries such as New Zealand, Hungary, Chile, Fiji, and South Korea have put it into legislation or in the process of legislation. Austria, Portugal, Costa Rica, Slovenia, South Africa, and Kazakhstan have issued policy announcements, which will play a role in mitigating global climate change.

(2) Encouraging Belt & Road countries and regions to come up with their carbon neutrality goals, while guarding against the risks associated with previous energy-intensive projects due to changes in energy investment policy. China should take appropriate measures to ensure the steady transition of its investment from traditional fossil energy to renewable energy, and edge into the advanced ranks of decarbonization project construction. In 2020, the cumulative investment in the fossil energy sector of Belt & Road countries and regions has dropped about 28 trillion US dollars from the estimated amount of 71 trillion US dollars. The existing energy-consuming projects are likely to face the risk of “assets on hold” brought about by the policy change. It is recommended that China-funded enterprises issue certain amount of “green transition bonds” for energy-consuming projects to reduce the loan cost in early-stage construction and operation and make up for the losses caused by project transformation.

Developing multilateral green cooperation, with special focus on the layout of green production network with the Central and Eastern European countries in economy, trade, and finance

It is suggested to develop China-Europe, China-UK, China-France and other multilateral green cooperation platforms to promote green investment and financing cooperation. China can learn from the developed countries in terms of green investment to promote low-carbon technology spillovers brought about by green investment.

Our calculation shows that central and eastern European countries have comparative advantages in green production. Therefore, it is advisable to strengthen green development cooperation with those countries, leverage their pivotal role and location advantage in the global production network, and learn the experience from their comparatively advantageous industries such as automobile industry, equipment manufacturing, and mechanical equipment in the transportation cluster. As of the end of 2020, China has had an accumulated investment of 3.14 billion US dollars in the Central and Eastern European countries, which only accounts for 3.2% of the total 98.62 billion US dollars in 2018. There is great potential for green investment and finance cooperation between China and Central and Eastern European countries.

Optimizing green investment entity structure to reduce climate financing risks

(1) Reducing climate finance risks and putting climate finance in a strategic position. It is recommended that investment companies should fully consider the scale of climate investment and financing projects as well as the complexity of participating institutions, carefully assess the associated risks, and build climate-resilient infrastructure to improve the sustainability of environmental benefits. Climate finance is an important tool to reduce such risks, and the current development of climate finance in China still needs to be improved. China-funded enterprises should try to seek loans from international financial institutions, strengthen their cooperation with multilateral financial institutions to expand hybrid investments, and diversify the financing channels with the help of their expertise in financial risk management.

(2) Optimizing the capital structure and debt structure of green investment entities in Belt & Road countries and regions. At present, China’s financial institutions have unsound mechanism for investment risk assessment and protection in Belt & Road countries and regions. There is an urgent need to optimize and upgrade the current risk assessment concepts, structures, and tools. At the same time, dispute resolution mechanisms should be established as soon as possible. Overseas investment insurance systems need to be improved, and more insurance policy support should be rendered. It is advisable to diversify the debt finance channels, let equity financing play its role, and optimize the capital structure of investment entities to support future debt financing.

Author

XIA Yan Associate Researcher of Institutes of Science and Development, Chinese Academy of Sciences (CAS).

YANG Cuihong corresponding author, Professor of Academy of Mathematics and Systems Science, Chinese Academy of Sciences (CAS).

Citation: XIA Yan, JIANG Qingyan, YANG Cuihong, WANG Shouyang.

This article is contributed by Bulletin of Chinese Academy of Sciences.